Tax Inclusive Financial Statement Analysis

ATRS software provides profit & loss statements, cash flow statements, balance sheet and comprehensive expense detail reports for an investor’s most important business: Their Wealth. It provides these reports because while performance reporting systems do a great job of presenting information in the context of investment vernacular and metrics, ATRS believes clients and advisors alike value a “dollars and cents” approach as presented in the clear context of our financial statements.

While financial statements might be considered by some as boring, there is a reason that they have withstood the test of time and act as the cornerstone of corporate reporting. (ATRS financial statements are not designed to comply to any accounting standards. Rather, they are designed to allow viewing an investor’s results through a common sense financial statement lens. While these reports are produced through ATRS, levels and degrees of customization might be allowable through specific performance reporting providers.)

Profit & Loss Statement

The Profit & Loss Statement provides a bottom-line dollar result for your investment program. While percentage returns, projections, and other investment industry metrics dominate reporting, there are still clients that just want to know, "In dollars and cents, what is my bottom line?" Most importantly, they want to know this number after taxes.

Cash Flow Statement

The cash flow statement is designed to track all of the transactions associated with the wealth management program. Often fees & expenses are paid through accounts not captured through the data feeds incorporated into your performance reporting system. (A classic example would be a tax payment made from am unreported checking account to a taxing authority). This report attempts to track these tax transactions even for "offline" accounts.

Balance Sheet

The balance sheet captures the market value along with unrealized tax attributes associated with all investment holdings. This level of detail provides a much more accurate representation of portfolios’ liquidation values. Perhaps more importantly, these unrealized tax attributes allow for a better, more thoughtful approach to implementation and rebalancing portfolios.

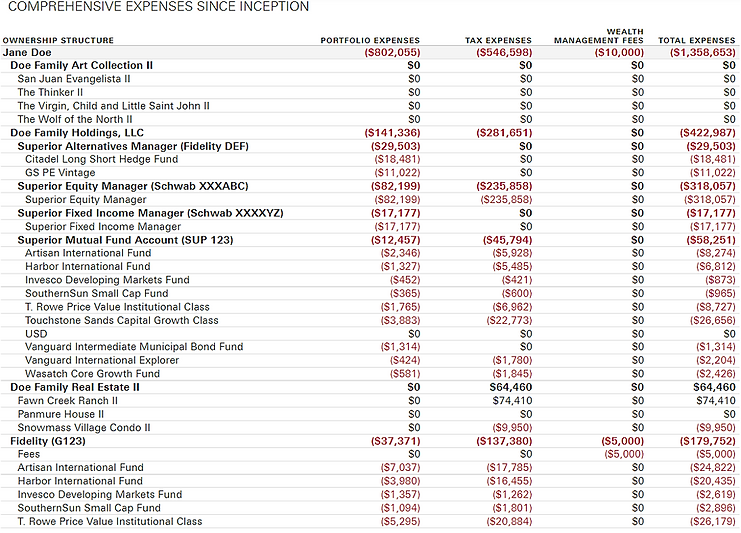

Comprehensive Expense Detail

The Comprehensive Expense Detail captures all fees associated with an investor’s wealth management program.

Portfolio Expenses are investment expenses that are paid directly from the portfolio. They include mutual fund expense ratios, limited partnership management and incentive fees, and money manager fees. In the case of these expenses, the numbers are estimates based upon reported Morningstar Expense Ratios, investor's understanding of their limited partnership fee arrangements, and fees debited and reported from the custodian.

Tax Expenses are based upon client specific tax rates and various income tax assumptions agreed upon by ATRS and client. ATRS does not provide tax or accounting advice. All tax-related information is for informational purposes only and should not be relied on for tax or accounting advice. Please consult your tax, legal and accounting advisors before engaging in any transactions.

Wealth Management Fees are fees that are paid either related to the management of your investment program (advisory fees) or to the maintenance of your overall wealth management process (accounting, legal, etc.) fees. These fees are paid directly by the client but maintained in the reporting system.